Please click here to be redirected to the updated blog: http://tomorrowsinvestor.rsablogs.org.uk

Blog being redirected…..

February 17, 20093. Amateurish and Self-interested city managers:

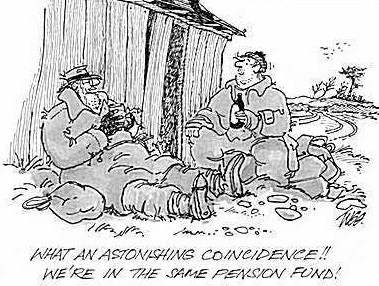

February 12, 2009Everyone who is engaged in providing the pension funds including fund managers has their role to play in servicing the pension fund industry poorly and for their own best interest. I am not talking about overconfident and bonus driven culture of fund management here. In fact, I am referring to managers with limited knowledge about their clients, un appropriately equipped to make investment decisions for their client and in some cases not qualified enough.

It is claimed that hundreds of pension schemes were misled by one of the biggest fund managements who is accused of giving “negligent” advice that cost about 100 pension schemes more than £300m.

The allegations made in the dossier were first reported in the Sunday Times.

Allegations

The allegations were made by an independent actuarial consultancy relating to advice given in 1999 and 2000 at the height of the stock market boom, at the time, one of the leading financial institution in UK takeover this fund management.

Then, the consultancy claims, the pension fund schemes were encouraged by the fund management company (actuaries) to give up appropriately invested plans, yielding returns of around 7 per cent a year in addition to guaranteed annuity rates. The schemes were advised to switch to their managed fund, a higher-risk investment vehicle with much more exposure to shares, and surrender their annuity rate guarantees.

A consequence of this was to transfer the risk of pensioners living longer away from the fund management’s balance sheet and onto the individual company pension plans. Since the switch, the fund has performed poorly and annuity rates have fallen to reflect lower interest rates and improved life expectancy: – a situation that has collectively cost the schemes about £300m.

As a result, the schemes are significantly less well funded, less solvent; and require a higher contribution rate from both employer and employee.

“Life assurance companies exist to assume risk but this is yet another example of a major brand simply abdicating its responsibility to its clients by shifting risk off its own books and onto the less powerful shoulders of clients,” said Arc director Roger MacNicol.

Therefore, it can be concluded that the advice to have been motivated by self-interest and not in the best interests of the pension funds.

If you have managed to escape any of the above scenarios discussed and believe your chosen personal pension will provide you with the comfortable retirement, you must think again.

Tomorrow I will talk about high Annual Management Charges (AMC) that may end up costing you almost 40 per cent of the value of pension fund over its life time.

2. Poor management of pension funds

February 11, 2009There is a lot written about the mismanagement of funds, which refers to the lack of risk management (financial and Market) and irresponsible behaviour, leading to an incorrect investment decision.

However, here, by mismanagement I mean lack of proper administration and therefore lack of operational risk management (Operational risk management – Wikipedia) which leads to the administration errors of our hard earned money. This will include clerical errors, processing mishap and mishandling of the information which often does not get reported and therefore not accounted for whilst estimating the loss of value of our pension fund.

However, after a little bit of struggle, I found some examples of clerical and processing errors which were made public and may give you some indication of the losses.

In 2007, BBC (http://news.bbc.co.uk/1/hi/world/asia-pacific/7140165.stm) reported that Japan’s government is finding it hard, for almost 20 million cases, to confirm “who owns what” after a mishandling of the information by social insurance agents.

Last year, employees at a leading printer company in the UK went into liquidation. At the time employees were owed nearly £400,000 in wages and pensions contributions. It is believed April’s pension contributions were not passed on by the company to the insurance company and therefore only the existing assets of the pension fund had been protected.

Also, In January 2008, a review of 49,000 Armed Forces Pension Scheme files found 98 veterans had been overpaid, some of them for decades, caused by clerical error for which details are not available. Now, the taxpayers may have to foot the bill for £1.7 million (http://www.telegraph.co.uk/news/uknews/1576138/MoD-pension-error-costs-taxpayers-1.7m.html)

On speaking with one of the company, it was clear that most of the common mismanagement such as delay in processing pension money: the time it is deducted from salary and transferred into the investment account, losing returns for the investors are not even accounted for.

And maybe as an active reader of this blog, you would like to share some of the administration errors you have come across and think someone should be held accountable for.

Therefore, it is more important that investors should take ownership of their investment whilst ensuring not only service providers but also our employers are working efficiently and practicing a good operational risk management framework.

1. Intelligent bankruptcy:

February 10, 2009The right of workers to their pension payments is threatened by the firms going bankrupt and into administration, which is no doubt has increased recently as a result of a credit crunch.

The clever investors are using pre-pack administration as a tool to able to go into bankruptcy only to then immediately repurchase the most profitable and valuable parts of their operations with the consent of “Secured Creditors”. Business is then transferred to the purchaser without concerning “Unsecured creditors” (Unsecured creditor ) which includes pensioners and their liabilites such as a pension scheme deficit.

For instance, as an unsecured creditor, the Woolworth final salary pension scheme, which is believed to have a deficit of at least £8m, is now expected to log a Section 120 Notice with the Pension Protection Fund (PPF).

The PPF is an insurance fund set up by the government in 2005 to meet the pension bill of insolvent companies. Under the PPF, those employees who have not reached normal pension age, i.e. the vast majority, are only entitled to 90 per cent compensation (Protecting People’s Pensions).

As a result of the PPF rescue, a pensioner can face a cut, an independent consultant estimates, in the pension value by 20 per cent. This is 3 per cent higher than what is contributed by devaluation of stock.

If this discovery was not bad enough, the mismanagement of the pension funds by the administrator including employers has also unfolded recently. The interesting evidence about which will be discussed tomorrow.

Four critical factors contributing into declining value of pension funds

February 9, 2009

In the past year pension schemes run by the UK’s largest 100 companies have seen £65 billion of their asset values wiped out. According to Deloitte (GAAP, 2nd January 2009) this is the equivalent to 17 per cent or five years’ worth of current pension contributions.

After reading above headline, watching Evan Davis on the BBC (BBC iPlayer – The City Uncovered with Evan Davis) and listening to the endless discussion on radio, It is hard not to conclude that the banking industry, traders and regulator are to blame.

They all claim that “Credit Crunch” has resulted in the decline in the value of stock and hence the value of our pension funds.

However, after further investgation, It seems that for all these years, long before the credit crunch, there have been other factors contributing into the declining value of pension funds.

The majority of us are not capable or able to make critical decisions about our pension schemes, decide on investment strategy and annuity and put our trust on the service providers who are expected to be making decisions for the benefit of their client. Instead, what these beneficiary getting are:

- Lack of appropriate protection from the government

- Complicated investment strategies which are not understandable by majority of us

- Clever service providers who put their interest first over the beneficiaries

- Lack of accountability by the administrator of their funds

Therefore, in next few days, I will be talking about how following critical factors that have contributed into the decline of pension funds over the years.

- Intelligent bankruptcy

- Amateurish and Self-interested city managers

- Poor management of pension funds

- High Annual Management Cost (AMC)

In the mean time take a look at the following headlines….